Owning a home is the American dream!

That’s what we’ve always been told right?

Sure, there are always naysayers out there that will tell you otherwise, or that it’s better to rent long-term (I’m hearing more of this today, stop that crazy talk!)

I’ve always been in the camp of owning > renting… And I’ll give you my top 5 benefits to homeownership, and why it kicks ass compared to renting long-term.

1. Predictable monthly housing payments

A landlord can jack up your rent whenever your lease contract expires. You either have to accept it and sign the new lease, or, find a new place! In the greater Chicago area, including homes in Algonquin, Lake in the Hills & Huntley, rents have been on the rise for the last 8 years.

When you buy a home, you can lock in a predictable mortgage payment for as long as 30 years. Nice!

And part of your payment goes towards paying down your principal balance, so it’s going towards something. You can also write off your interest and property taxes up to $10,000 (more on this later).

There are fluctuating costs like taxes & homeowners insurance, but the mortgage is locked in for 30 years if you opt for a 30-year fixed loan, which most borrowers do.

2. Appreciation

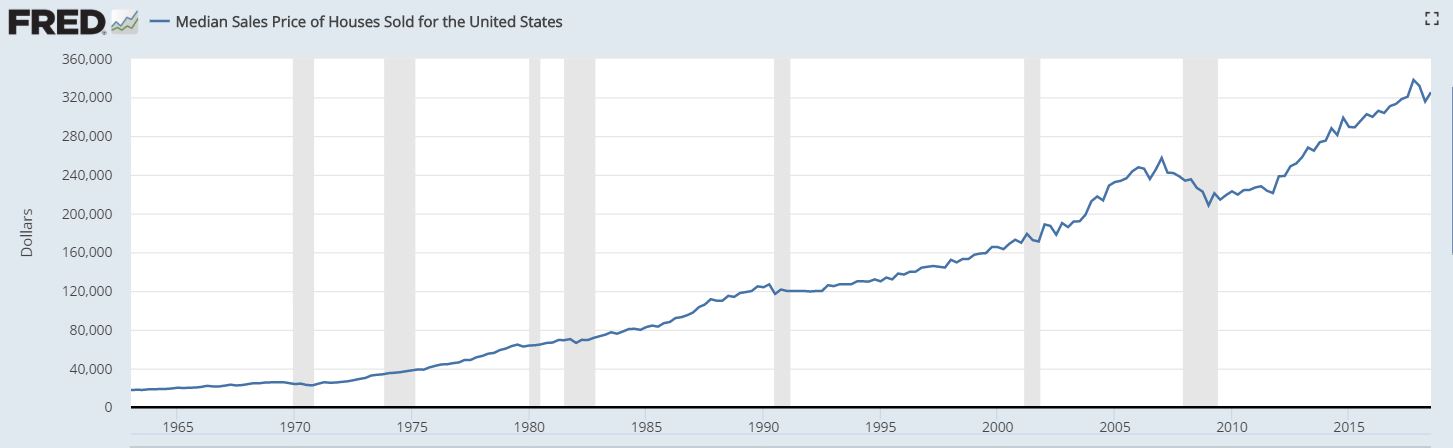

When you purchase a home, there is a possibility of that home appreciating in value of the years! Many families have built their wealth and secured their financial future on home value appreciation and long-term homeownership.

The market does go up & down, as history has shown. In fact, 2008 was one of the worth housing market crashes we’ve ever seen, and property values took a big decline.

But, even with market crashes, over the FULL life of your 30-year fixed loan, there’s a very good chance that your home will be worth more than what you bought it for. I’ll take my chances!

3. Tax benefits

With homeownership comes some amazing tax benefits, that could potentially save you some extra money when tax season arrives. You can write off the property taxes (up to $10,000) and your mortgage interest!

I can tell you that personally, I save roughly $4,000 every year from just my tax write offs on my property taxes & interest.

But, I highly recommend talking to an accountant, as everyone has a different situation based on income, tax brackets, and your mortgage payments.

4. Freedom to make modifications

This is pretty simple – it’s your house, you can do whatever you want to it! Most houses in Algonquin, Huntley & Lake in the Hills have all been modified by their owners over the years. And when you buy a home, it’s no different, you can make changes too!

Keep in mind that if you’re making changes that require permits, you should check with your local city or village. If you’re unsure, I would call first or go to your city’s website… And if you’re in a homeowner’s association, make sure you read through the rules and regulations before you make any changes to your home.

5. Provide a “Nest Egg” for Retirement

Paying off your mortgage after 30 years is a wonderful thing, especially once you retire (or sooner perhaps). It’ll give you a lot more financial freedom, as you’re sitting on an asset that is worth hundreds of thousands. And it’s paid for!

If you were to rent for that same 30 years, and you paid $1500 a month, you would have paid $540,000 in rent payments. And the worst part is, you’d have nothing to show for it. No place to call your own.

Now, on the flip side, if you move around a lot for work, or you’re uncertain on where you’ll be living in the next 1-3 years, it may be better to rent for now. But if you’re planning on establishing your roots for at least 5 years, I think it’s better option to call a realtor, get pre-approved for a mortgage, then start looking at homes.

These are just my Top 5 benefits to homeownership. You can also check out this video at my youtube channel: Click Here

For more information or questions on how to own a home, contact me and I’ll get you started down the right path.

Thank you for taking time to give this a read! And please share with anyone you know that is looking to sell or buy a home in the Algonquin, Lake in the Hills, Huntley, Crystal Lake or surrounding area… I hope I’ve provided some value!

patrick@103realty.com / 312.217.4398